SUPER CHANGES ADD FLEXIBILITY

Posted on August 4, 2020

Just when you thought you had a grip on the superannuation rules, they change again. This time though, the changes are mostly positive, especially for older super members keen to top up their savings.

From 1 July 2020, changes came into effect with the potential to help retirees as well as members suffering financial hardship due to the economic impacts of COVID-19.

If you are not working you may be able to contribute to super for longer, while couples can take advantage of spouse contributions for longer. The temporary reduction in minimum pension drawdowns remains in place, as does early access to super. And if you own a business, you have a brief window of opportunity to get up to date with your employees’ super payments without penalty.

Here’s a summary of the new rules.

WORK TEST TO KICK IN AT 67

Under changes to the work test, if you are aged 65 or 66 you can now put money into super even if you aren’t working. This gives people flexibility to make voluntary catch-up contributions for a few more years and give their retirement savings a last-minute boost.

Say you are 65 and inherit some money. You can now make a voluntary non-concessional contribution to your super account up to the annual limit of $100,000, even if you are not currently working enough hours to satisfy the work test. You can make withdrawals from this money or start a super pension.

Under the work test, which now kicks in at age 67, you must work at least 40 hours within 30 consecutive days in the financial year in which you make the contribution.

It was also proposed to allow people aged 65 and 66 at the start of the financial year to use the existing non-concessional bring forward rules. If eligible, this allows you to ‘bring forward’ up to three years’ worth of non-concessional contributions (up to $300,000) in the current financial year. Legislation must be passed before this proposal becomes effective.

COUPLES GET A SUPER BOOST

Couples also have more flexibility to grow their retirement savings later in life, thanks to recent changes to spouse contributions. As of 1 July 2020, you can contribute to your spouse’s super fund until they reach age 75, up from the previous age limit of 70.

What’s more, if your spouse (married or de facto) earns less than $37,000 you may be able to claim a tax offset of up to $540 for your contribution to their super. The offset phases out once your partner’s income reaches $40,000.

The usual non-concessional contribution limits still apply, and the receiving spouse still needs to meet the work test where applicable (outlined above).

SUPER PENSION DRAWDOWNS HALVED

Retirees whose superannuation has taken a hit from the COVID-19 market volatility have also been given a bit more wriggle room this financial year. The government has temporarily halved the minimum amount retirees must withdraw each financial year from their account-based super pension.

This temporary measure will help retirees who might otherwise have to sell assets at depressed prices to provide cash for their pension payments.

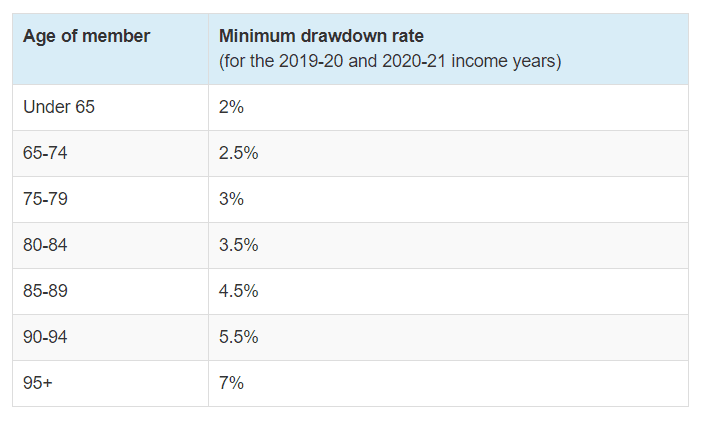

For example, someone aged 65 would normally be required to withdraw 5 per cent of their super pension account balance each financial year. But in 2020-21 they need only withdraw 2.5 per cent of their account balance if they wish. The minimum drawdown rate increases gradually with age, reaching 7 per cent from age 95 under the temporary rules (normally 14 per cent), as you can see in the table below. There is no maximum withdrawal rate.

Table 1: Minimum pension drawdown rates (as a percentage of your super pension account balance)

Age of beneficiary |

Temporary withdrawal rate

|

Normal withdrawal rate |

| Under 65 | 2% | 4% |

| 65 to 74 | 2.5% | 5% |

| 75 to 79 | 3% | 6% |

| 80 to 84 | 3.5% | 7% |

| 85 to 89 | 4.5% | 9% |

| 90 to 94 | 5.5% | 11% |

| 95 and older | 7% | 14% |

Source: ATO

EARLY RELEASE OF SUPER

Younger super fund members have not been forgotten. You can withdraw up to $10,000 from your super account this financial year if you are suffering financial hardship due to the economic impact of COVID-19. This is in addition to the $10,000 you could withdraw last financial year.

It must be stressed though, that the early withdrawal of your super should be a last resort because of the adverse impact on your retirement savings. An amount of $10,000 withdrawn early in your working life could potentially be worth many times that by the time you retire.

If, after weighing up your financial options, you wish to take advantage of this temporary measure then you need to apply by 24 September 2020.

SUPER GUARANTEE AMNESTY FOR EMPLOYERS

If you run your own business and you have taken your eye off the ball when it comes to paying the correct amount of super to your employees, then the Australian Taxation Office (ATO) is offering a temporary amnesty to set things right.

You have until 7 September 2020 to disclose and pay any unpaid Super Guarantee (SG) amounts for your employees. These contribution shortfalls can be from any quarter from 1 July 1992 to 31 March 2018.

Under the amnesty, you will not have to pay the administration charge or Part 7 penalty (up to 200 per cent of the Superannuation Guarantee Charge). You can also claim a tax deduction for your payments.

If you would like more information about any of these changes or how to take advantage of them, give us a call.

RECENT POSTS

Like it or not, we live in interesting times. More than a decade after the Global Financial Crisis, the global economy is facing fresh headwinds creating uncertainty for policy makers and investors alike. This time around it’s not a debt crisis, although debt levels are extremely high, but geopolitical instability.

After one of the hottest summers on record, many Australians will welcome Autumn and the opportunity to be more active outdoors and perhaps get busy in the garden. There will be no let-up in the heat on the political and economic front though, with the Budget and a Federal election looming.

For many people, there’s much more to choosing investments than focusing exclusively on financial returns. Returns are important, but a growing number of people also want to be assured that their investments align with their values.